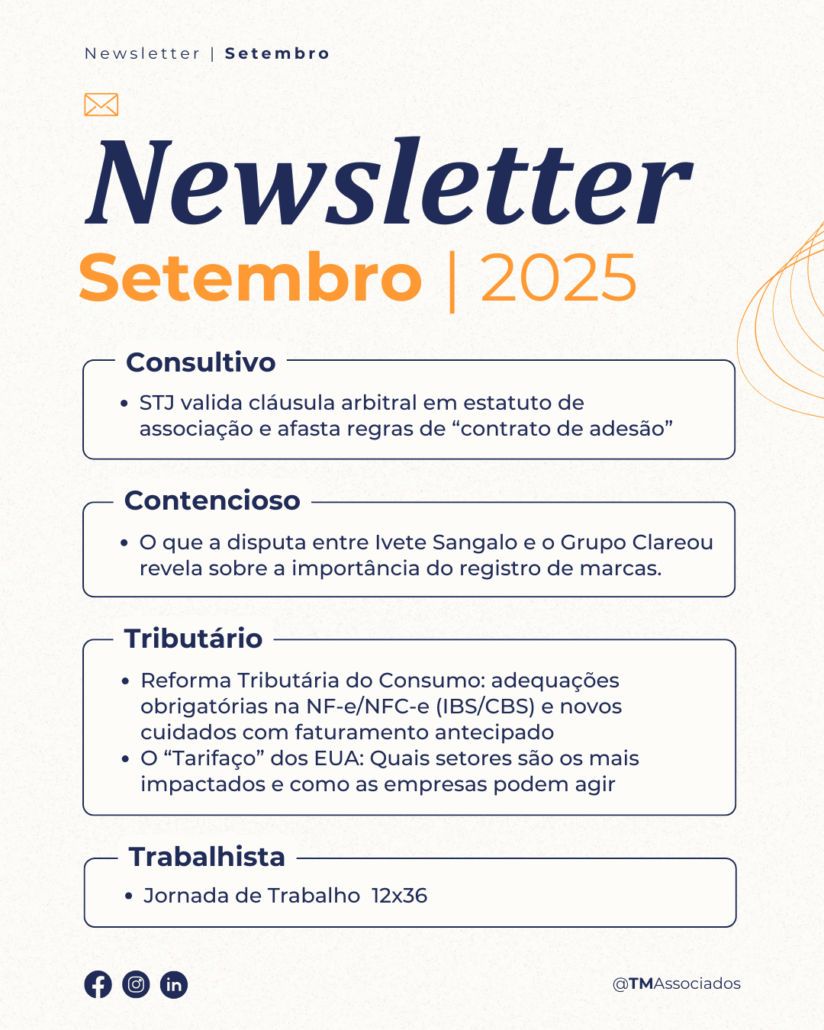

Newsletter | SEPTEMBER/2025

Every month, the TM Associados team brings you a newsletter with essential topics for the success of your business. We address the main highlights in a practical and objective way.Advisory, Litigation, LaborandTax, helping you make safer and more strategic decisions. Don’t miss this opportunity to transform information into a competitive advantage!

Advisory:

Superior Court of Justice (STJ) validates arbitration clause in association bylaws and dismisses “adhesion contract” rules.

The 3rd Panel of the Superior Court of Justice (REsp 2.166.582/SC) ruled that an arbitration clause inserted in the bylaws of a civil association is valid, and the requirements of Article 4, §2, of the Arbitration Law (rules for adhesion contracts) do not apply.

The Court highlighted that the statute stems from a collective decision, with debate and voting in an assembly, and should not be confused with an adhesion contract. Therefore, there is no need for express individual consent. Questions regarding the validity or effectiveness of the clause should, as a rule, be analyzed by the arbitral tribunal itself.

Understand the case

An association approved the inclusion of an arbitration clause in its bylaws during a general assembly. A former member alleged nullity due to the absence of express individual consent. The Superior Court of Justice (STJ) concluded that the association’s bylaws result from a collective decision and do not constitute an adhesion contract; therefore, the specific highlighting or acceptance required for arbitration clauses in adhesion contracts is not necessary.

An association approved, in a general assembly, the inclusion of an arbitration clause in its bylaws, with a former member contesting the validity of the change on the grounds that he had not given his express individual consent.

Regarding this matter, the Superior Court of Justice (STJ) concluded that the bylaws result from collective deliberation, with debate and voting by the members, and should not be confused with adhesion contracts. Therefore, in these cases, individual acceptance in a separate or highlighted document is not required, as is the case in adhesion contracts where an arbitration clause is included.

The decision: associative autonomy and the competence of the arbitration tribunal.

According to the ruling reported by Minister Nancy Andrighi, Article 4, §2, of Law 9.307/1996 does not apply to the statutes of associations, and it is generally up to the arbitral tribunal to analyze allegations of nullity or ineffectiveness of the arbitration agreement, except in cases provided for by law.

The guidance reinforces that the clause can apply to all members, including those who were already part of the entity, provided that the statutory amendment observes the formalities, namely, convocation, quorum, minutes, and registration.

Practical implications for governance and dispute resolution.

- Statutory provision:Arbitration can be instituted by a resolution of the shareholders’ meeting, without the need for separate individual acceptance.

- Competent forum:Any disputes regarding the validity and scope of the agreement fall under the jurisdiction of the arbitral tribunal.

- Change procedure:It is essential to comply with legal and statutory quorums and formalities.

- Reach:The clause applies to all members, including those already affiliated, provided that the formalities are observed.

- Limits:The decision applies to civil associations, not to consumer relations.

How can TM Associados help?

Our consulting team supports your organization in implementing good governance practices and conflict resolution, offering:

- Review and adapt bylaws to include a clear and effective arbitration clause (arbitral institution, rules, language, costs, number of arbitrators and modality);

- Conducting meetings to amend bylaws, observing quorums and legal formalities;

- Drafting multi-step clauses (negotiation or mediation prior to arbitration) and internal dispute management policies;

- Mapping impacts and preparing communications for members, ensuring transparency;

- Training for boards of directors and councils on the correct use of arbitration.

Consolidating sound statutory practices increases predictability, strengthens governance, and reduces unnecessary litigation. TM Associados is prepared to structure your association with legal certainty.

Litigation:

What the dispute between Ivete Sangalo and Grupo Clareou reveals about the importance of trademark registration.

In recent months, a dispute involving singer Ivete Sangalo and the Clareou Group has gained media attention and brought to light an essential topic in the business world: trademark registration.

The impasse began after the launch of the “Ivete Clareou” tour, whose name caused discomfort on the part of the pagode group, which owns the trademark “Grupo Clareou” registered with the National Institute of Industrial Property (INPI). According to the group, Ivete’s use of the name would cause confusion among the public and constitute unfair competition, in addition to disrespecting the rights previously acquired over the trademark.

On the other hand, the singer’s team defended themselves by claiming that the trademark registration exclusively covers the expression “Grupo Clareou,” and not the term “Clareou” in isolation. They further argued that “clareou” is a commonly used word in the Portuguese language and that, combined with Ivete’s name, it would not constitute misappropriation.

Experts interviewed by the press reinforced that the combined use of distinct elements can indeed coexist with already registered trademarks, as long as there is no exploitation of another’s reputation or real risk of confusion among the public.

Given this scenario, the case clearly demonstrates how business disputes involving trademarks can arise even among major market players, and that the absence of legal precautions can result in public clashes, damage to reputation, and even the suspension of campaigns. Above all, it shows that the mere use of seemingly generic terms does not exempt any company or artist from potential legal disputes, especially when it comes to names associated with already established businesses.

What does this reveal about business litigation?

This case highlights a fundamental point: trademark litigation is not limited to large corporations or the traditional corporate environment. It also affects the artistic and creative sector, where the symbolic value of a brand is strongly associated with public image and reputation built over time.

Furthermore, it shows how the use of similar names, even if partially distinct, can generate conflicts when there is overlap in performance or target audience. Although Ivete Sangalo and Grupo Clareou operate in different segments of the music industry, both are part of the entertainment market and have national projection, which can lead to undue association on the part of the public.

Another important point is that, even with formal registration at the INPI (Brazilian National Institute of Industrial Property), trademark exclusivity is not always absolute. Generic expressions, common names, or words from everyday vocabulary can be registered, but their protection requires specific criteria, such as continuous and notorious use, the context of application, and the real risk of confusion.

This type of litigation is, therefore, a warning sign for any company that wishes to preserve its intangible assets. Failure to pay attention to this aspect can lead to financial losses, lawsuits, rework, and damage to its image.

Essential lessons for businesses:

From the case of “Ivete Clareou vs. Grupo Clareou,” we can extract several practical lessons that apply to the daily operations of any company, whether small, medium, or large:

- Conduct a prior art search before launching a trademark:Before announcing any product, service, or campaign name, it is essential to check if a trademark with similar elements already exists. This simple step can prevent lengthy and costly legal processes in the future.

- Register your brand strategically:Choosing generic or commonly used names can weaken your legal protection. Whenever possible, combine distinct elements and be creative, ensuring greater exclusivity and legal security.

- Keep documentation that proves continued use:Even if a trademark is not yet registered, it is possible to prove the right of precedence if there is concrete evidence of continuous, recognized, and prior use. This includes promotional materials, social media, contracts, presentations, and more.

- Consider the risk of inappropriate association:It’s important to analyze whether your brand could be confused with another already existing in the market, especially if there are visual, phonetic, or target audience similarities. This analysis should go beyond the literal meaning of the name.

- Take a preventative and conciliatory approach:Many conflicts can be avoided with a simple conversation or prior negotiation. Instead of litigating, seeking consensual solutions can preserve relationships and the image of both parties.

How can we support your company?

Based on our experience with intellectual property and corporate litigation, we offer a suite of solutions to protect your company from the conception to the management of your brand:

- Brand analysis and feasibility:We conduct searches at the INPI (Brazilian National Institute of Industrial Property) and identify legal risks before launching the product/service;

- Trademark registration at INPI:We take care of the entire formalization process, including word marks, figurative marks, and mixed marks;

- Brand portfolio management:We manage deadlines, renewals, and monitor potential market violations;

- Representation in administrative and judicial litigation:We defend your rights before the INPI (Brazilian National Institute of Industrial Property), competitors, and judicial bodies, should a challenge or defense be necessary.

Labor

WORK SCHEDULE 12×36

The 12×36 work schedule, widely adopted in sectors such as health, security, surveillance, commerce, and cleaning, continues to be the subject of relevant legal debates. Although regulated by the 2017 Labor Reform, the topic still raises controversies, especially regarding the form of agreement and the remuneration for holidays.

In recent years, the Brazilian Supreme Federal Court (STF) and the Superior Labor Court (TST) have been consolidating understandings aimed at ensuring greater legal certainty for labor relations that adopt this regime. However, inadequate formalization or non-compliance with the rules still generates considerable risks for employers.

With the inclusion of article 59-A in the CLT (Consolidation of Labor Laws), the Labor Reform expressly authorized the 12×36 work schedule by written individual agreement, without the need for a collective bargaining agreement, except in cases of unhealthy activities, which continue to require union participation.

One of the points that generated the most disagreement was the payment for holidays worked. Some case law held that, even with compensation, work on holidays required double pay. However, the Superior Labor Court (TST) consolidated the understanding that, if there is a valid agreement in the 12×36 shift system, there is no obligation to pay double for holidays worked, provided there is compensation for working hours.

In other words, with a formal agreement and compensatory time off, double pay is not required. In the absence of a valid agreement, the employer may be obliged to pay for holidays worked with the legally mandated surcharge.

It is still common for companies to adopt the 12×36 shift system without formal contracts or through verbal agreements, which generates significant liabilities. Labor courts have deemed informal agreements null and void, ordering employers to pay double for holidays, overtime beyond the 12th hour, and moral damages in cases of exhausting work schedules.

Therefore, the 12×36 shift remains a legitimate and useful tool, especially for sectors with uninterrupted schedules. However, its adoption requires technical and legal rigor, with proper formalization, effective shift control, and respect for legal limits.

Although recent decisions by the STF (Supreme Federal Court) and TST (Superior Labor Court) have contributed to greater legal certainty, the lack of proper formalization or the improper application of the 12×36 work schedule still represent significant risk factors and labor liabilities.

To illustrate, In November 2021, the TST (Superior Labor Court) confirmed the right of a nursing technician to double pay for holidays worked because the employer did not prove compensatory time off (RR-937-67.2020.5.12.0028). The decision reinforces that the formality and registration of compensation are indispensable even after the Reform.

Therefore, we have provided a checklist of preventative measures to avoid liabilities:

Quick compliance checklist

- Draft agreement: keep the standard template reviewed by legal counsel.

- Time tracking: use an auditable electronic system.

- Holidays: ensure compensatory time off is included in the schedule; record it on the time sheet.

- Unhealthy work environments: involve the union and attach the PPRA/PGR report.

- Audit: Review schedules with each shift or department change.

The 12 x 36 shift schedule remains legitimate and strategic for uninterrupted sectors, but its legal security depends on:

- a firm written agreement,

- strict control of holiday compensation, and

- respect for special conditions (unhealthy working conditions, breaks).

Companies that ignore these points still face significant penalties.

Doubts?

Our labor team is available to assist you.

Tax

Consumer Tax Reform: Mandatory adjustments to NF-e/NFC-e (IBS/CBS) and new considerations regarding advance invoicing.

Technical Note 2025.002-RTC (version v.1.01 and updates) adjusts the NF-e and NFC-e layouts for the Consumption Tax Reform, inserting IBS (Tax on Goods and Services), CBS (Contribution on Goods and Services) and Selective Tax (IS) fields.

Official schedule:Testing from July 1, 2025; production optional from October 1, 2025; mandatory in January 2026 (documents without IBS/CBS will be rejected).

2) Main changes in NF-e/NFC-e

- New groups/fields in the XML to report the tax rate, base, and value of IBS/CBS/IS per item, totals per document, and details by state/municipality (facilitates sharing and auditing).

- New validation rules and “events” (e.g., adjustments, cancellations, credit allocation, allocation for consumption, etc.).

- Updated tables/codes (including specific IBS/CBS classifications) published on the NF-e Portal.

Practical impact:ERP and tax systems will need to capture taxes by item, review accounting integrations, and automate reconciliations; granularity increases the tax authorities’ ability to cross-reference data.

3) Advance billing: it changes the game.

NT 2025.002 created “Purpose 6 – Debit Note” for advance payment/billing, which anticipates the incidence of IBS/CBS at the time of the advance payment.

Furthermore, “Debit Type 06 – Advance Payment” and “07 – Inventory Loss” are now added. When there is an advance payment without actual delivery, the event “Non-occurrence of delivery with advance payment” must be recorded.

Risk if not adjusted:Classification errors may result in double taxation, credit denials, and invoice rejection starting in January 2026.

4) Electronic Service Invoice (NFSe): who should issue them (and what hasn’t changed)

NT 2025.002 deals with NF-e/NFC-e. For services, the issuance remains the municipal NFSe.Obligation:Generally, all service-providing legal entities (Real Profit, Presumed Profit, and Simplified Tax Regime) are eligible. MEI (Individual Microentrepreneur): mandatory only when providing services to legal entities (for individuals, it is generally optional). Rules and systems vary by municipality (or national standard where adopted).

5) Timeline and checkpoints

- From 01/07/2025 –Approval/testing do novo layout NF-e/NFC-e.

- From 01/10/2025 –Optional production(It is recommended to enter)soft-launchto stabilize).

- As of 01/2026 –MandatoryDF-e without IBS/CBS/IS will be rejected.

6) What your company needs to do now (checklist)

- ERP & DF-e Update to layout 2025.002-RTC (NF-e/NFC-e) and enable IBS/CBS/IS per item. Implement Purpose 6 and Debit Types 06/07 with the corresponding events.

- Policies and contractsReviewing advance payment/billing clauses: when to issue a debit note, the moment the event triggers the payment, returns/cancellations,split payment(if applicable).

3. Fiscal/Accounting

- Adjust chart of accounts (IBS/CBS to be collected/recovered; presumed credits; IS).

- Map transactions involving credit/deferral/refund and their respective events.

- NFSe GovernanceConfirm municipal rules and internal procedures for service provision (including MEI/Simples and corporate clients).

- Training To train tax/accounting/finance and IT professionals on new codes, events, and impacts of advance billing.

7) Quick FAQs

- If I receive an advance payment in October 2025, do I need to issue a debit note now?Technically, the production environment has been open since October 1, 2025; we recommend entering the new workflow in 2025 to avoid friction in January 2026.

- What if the delivery doesn’t happen after the advance payment?Issue the event “Non-occurrence of supply with advance payment” to regularize the incident and ensure traceability.

- Service provision: should I replace NFSe with NF-e?No. Services are handled by NFSe (municipal/national standard where available). NT 2025.002 deals with NF-e/NFC-e (goods/consumer goods).

8) How can TM Associados help?

- Fiscal impact assessment.

- Contract review (advance payments, partial deliveries, cancellations and billing clauses).

- In-company training for tax/accounting/finance/sales teams.

- Continuous support during the transition (pilot 2025 → mandatory 2026).

The US “Tariff Surge”: Which sectors are most impacted and how can companies react?

At the end of July, the United States government announced a significant increase in tariffs applied to imports from Brazil. The measure raises the rate to 50% on most products that Brazil exports to the American market. In practice, this means that almost all Brazilian goods will arrive in the United States with a significant additional cost, reducing their competitiveness compared to competitors from other countries.

This measure came a few months after another decision in April, when the American government had already set a 10% tariff on imports from several countries. Now, with the new order, Brazil is one of the few countries to suffer such a sharp increase, with the tariff rising by another 40 percentage points.

It is worth remembering that some products were excluded from this increase and continue to pay the previous 10% tariff, such as civil aircraft, petroleum and derivatives, wood pulp, and orange juice.

The United States is among the main destinations for Brazilian exports, especially manufactured goods and agricultural products. A tariff increase of this magnitude considerably raises the final price of Brazilian items in the American market, encouraging buyers to turn to suppliers from other countries. This change tends to reduce the volume of foreign sales, affecting domestic production and jeopardizing jobs in the most impacted sectors.

Which sectors will be most affected?

The decision affects each sector of the economy differently:

- Agribusiness:Products such as coffee and beef, which were not excluded from the high tariff, will face reduced profit margins and a possible drop in demand.

- Manufacturing Industry:Machinery, equipment, and chemical products will struggle to remain competitive due to increased export costs.

- Less affected sectorsAircraft, petroleum and petroleum products, and cellulose and wood pulp remain subject to the previous tariff.

In the case of pulp, the direct impact of the tariff increase was mitigated by including the product on the list of exceptions, maintaining the import tariff at 10%. This decision preserves, at least in the short term, Brazil’s competitiveness in this segment, since the country is one of the world’s largest exporters and the United States is among its main markets. Even so, the sector should remain attentive to possible revisions in US tariff policy, as well as to the indirect effects of the measure on logistics costs, exchange rates, and trade negotiations, which could influence profitability and the flow of shipments.

What changes in practice?

For Brazilian companies that export to the US, this tariff means:

- Products are more expensive at the destination.→ difficulty in competing with other international suppliers.

- Risk of falling salesAmerican customers may reduce orders or seek alternatives.

- Impact on our contractsIt will be necessary to renegotiate prices and terms with importers.

Recently, Brazil adopted a measure similar to that of other countries, instituting a 20% tax on international purchases of up to US$50 made by individuals, in addition to the state ICMS tax. These transactions, common on platforms such as Shein, Aliexpress, and Shopee, were previously exempt from import tax.

The measure, popularly known as the “blouse tax,” is part of the Remittance in Compliance Program, which aims to balance competition between imported products and those sold in the domestic market. The rationale is that the previous exemption created a tax imbalance, disadvantaging domestic merchants compared to the prices charged by foreign companies.

The implementation of the program was a result of pressure from Brazilian retailers, who had been losing competitiveness. With the growth of e-commerce during the pandemic, the domestic market suffered a strong impact: there was a drop in the volume of purchases and the price difference between national products and goods imported directly by consumers became more pronounced.

Effects of the measures

In Brazil, the main impact is felt by the end consumer, who bears the burden of the increased cost of low-value imported purchases.

In the United States, the effects are global, impacting supply chains, increasing the cost of imported products, and harming foreign exporters. In the Brazilian case, the application of the highest tariff among the affected countries included strategic sectors such as agribusiness, steelmaking, and manufacturing, generating direct repercussions on the national economy.

Therefore, measures are needed to mitigate the impacts arising from the tariff increase, such as:

- Review the product classification.to confirm whether they are actually subject to the 50% tariff or if they fall under any exception.

- Renegotiate contractswith clauses that allow for price adjustments in case of tariff changes.

- Seeking new marketsto diversify sales and reduce dependence on the US.

- Evaluate logistical and production alternatives., such as partnerships or partial production in other countries.

Conclusion

The US “tariff hike” against Brazil is a move that profoundly affects trade relations between the two countries. For the American consumer, it means more expensive Brazilian products. For the Brazilian producer, it represents a loss of competitiveness and the need for rapid adaptation.

It is not yet clear whether this measure will be permanent or whether it can be reviewed in the future, but the fact is that companies need to act now to protect their businesses and find ways to remain competitive on the international stage.

Contact us:

Get in touch and find out how we can help:

tm@tmassociados.com.br

www.tmassociados.com.br | (11) 2923-7989

Leave a Reply

Want to join the discussion?Feel free to contribute!