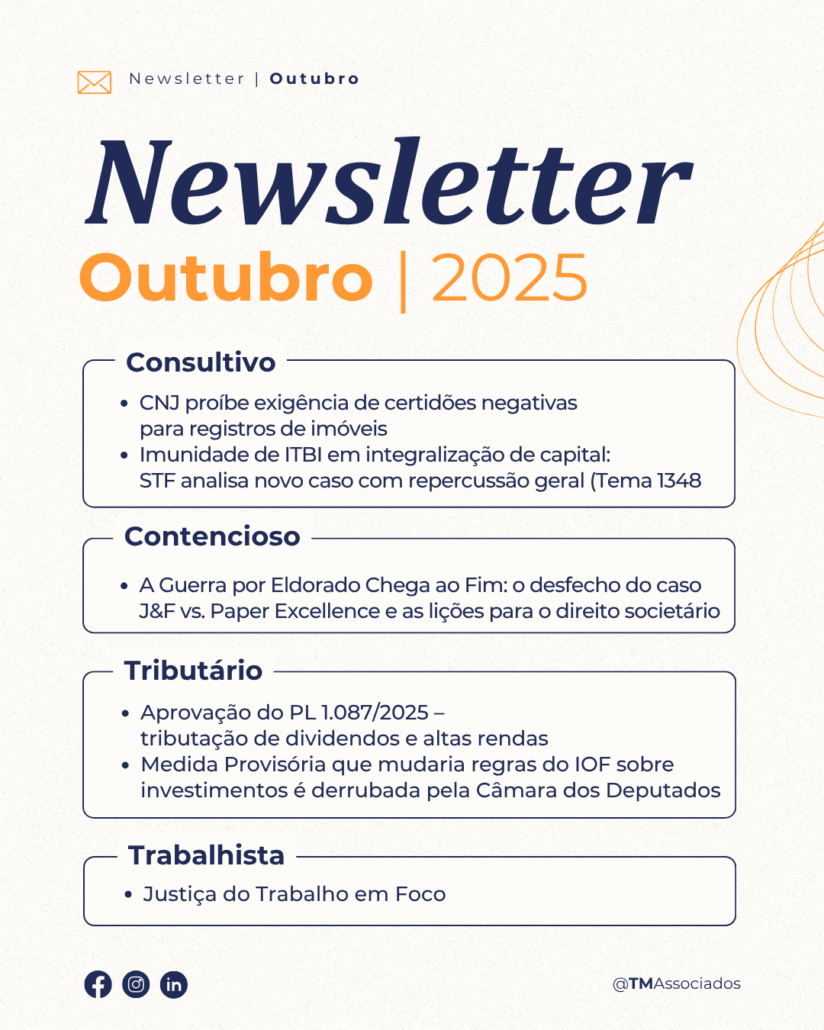

Newsletter | OCTOBER/2025

Each month, the TM Associados team brings you a newsletter covering essential topics for the success of your business. We address the most relevant highlights in Advisory, Litigation, Labor, and Tax matters in a practical and objective way—helping you make safer, more strategic decisions. Don’t miss this opportunity to turn information into competitive advantage! 📩

Litigation:

The War for Eldorado Comes to an End: The Outcome of the J&F vs. Paper Excellence Case and the Lessons for Corporate Law

To begin, it’s worth highlighting that few business disputes in Brazil have reached the level of complexity and public attention as the battle for control over Eldorado Celulose. Since 2017, J&F Investimentos—the holding company of the Batista brothers and controller of JBS—and Paper Excellence, linked to Indonesian businessman Jackson Widjaja, have engaged in one of the country’s longest and most sophisticated corporate conflicts.

Over the course of seven years, the dispute unfolded on multiple fronts—arbitral, judicial, and regulatory—involving issues of contractual execution, corporate governance, foreign land ownership, and the validity of arbitral awards. Now, with the announcement of a multibillion-dollar agreement, the case comes to an end, opening space for a deep analysis of what it reveals about high-stakes corporate disputes in Brazil.

1. Origin of the Dispute

In 2017, J&F agreed to sell 100% of Eldorado Celulose to Paper Excellence for approximately R$ 15 billion. The contract stipulated a two-phase sale: first, Paper acquired 49.41% of the shares, paying R$ 3.8 billion; then it committed to purchase the remaining shares within one year.

However, the second phase was never completed. Paper Excellence cited difficulties in securing financing from the China Development Bank, while J&F argued that the buyer had breached essential contractual clauses.

Meanwhile, regulatory hurdles emerged regarding land ownership by companies under foreign control—a sensitive issue in Brazil that requires authorization from INCRA and may involve constitutional restrictions. This impasse stalled the transaction and paved the way for an unprecedented legal dispute.

What began as a promising deal in the pulp sector evolved into a complex corporate war, involving multiple jurisdictions, international arbitrations, and high-stakes legal and economic implications.

2. The Litigation on Multiple Fronts

In 2021, the dispute was submitted to arbitration, which initially appeared to favor Paper Excellence, whose objective was to enforce the sale. However, J&F questioned the impartiality of one of the arbitrators, bringing the matter back to the judiciary.

The São Paulo State Court (TJSP) suspended the arbitral award’s effects, creating a deadlock between the arbitral tribunal’s decision and judicial oversight. Simultaneously, related proceedings were ongoing at the Federal Court of Appeals (TRF-4), involving land ownership issues, and at the International Chamber of Commerce (ICC) in Paris, where Paper Excellence even sought US$ 3 billion in damages.

The conflict thus crossed borders and became a true legal laboratory, exposing the frictions between arbitration, judicial control, and sectoral regulation.

3. The Settlement and Closure of the Dispute

Finally, in May 2025, the parties announced a definitive settlement. J&F repurchased the 49.41% of shares held by Paper Excellence for US$ 2.64 billion (approximately R$ 15 billion), regaining full control over Eldorado Celulose.

The agreement includes the full termination of all judicial and arbitral proceedings, both domestic and international. In a joint statement, the companies noted that the outcome “fully serves the interests of both parties,” bringing an end to a dispute that consumed substantial time, energy, and financial resources.

This move represents not only the conclusion of a contentious dispute but also a strategic decision: to end a conflict that had already become both a reputational and economic liability.

Conclusion

In short, the case of J&F vs. Paper Excellence / Eldorado Celulose is a landmark in Brazilian corporate litigation. It shows that in large-scale transactions, disputes are rarely limited to contractual disagreements alone—they often involve regulatory, strategic, and reputational dimensions.

On one hand, the episode reinforces that arbitration is not an absolute mechanism—it may be reviewed or suspended by the Judiciary when questions arise regarding impartiality or the validity of its foundations.

On the other hand, it highlights the importance of prior planning and regulatory risk management, especially in sensitive sectors like pulp and paper, which involve land assets and international investors.

More than a resolved dispute, the outcome symbolizes corporate maturity—choosing negotiation over confrontation. In times of legal and economic uncertainty, knowing when to end a battle may be the clearest sign of strength and strategic intelligence.

Advisory

CNJ Prohibits Requirement of Tax Clearance Certificates for Property Registration

CNJ Ruling

The Plenary of the National Council of Justice (CNJ) reaffirmed that notary offices and courts across Brazil may not require tax clearance certificates—such as the CND (Negative Debt Certificate) or the CPEN (Positive Certificate with Negative Effect)—as a condition for registering or recording real estate deeds.

The decision was issued in Administrative Control Procedure No. 0001611-12.2023.2.00.0000, reported by Councilor Marcello Terto during the 10th Virtual Session of 2025. The CNJ held that demanding tax certificates as a prerequisite for registration constitutes an indirect form of tax collection, contradicting precedents from the Supreme Federal Court (STF) and the Council itself.

Key Legal Aspects

- Indirect tax enforcement – Conditioning property registration on the presentation of tax certificates represents a “political impediment” and an improper means of tax collection.

- STF precedents – The Supreme Court has previously ruled that this kind of requirement violates the principle of tax legality and the right to property.

- Permissible exception – Notaries may request certificates for informational purposes only, allowing the buyer to assess the seller’s tax situation, without blocking the registration.

- Invalid local rules – Any state or municipal laws or regulations that impose such requirements are considered illegal and unenforceable.

Practical Impact for Individuals and Businesses

- Security in real estate transactions – Registration cannot be denied due to the absence of tax certificates, ensuring greater speed and predictability.

- Fiscal due diligence – While certificates are not mandatory for registration, it is recommended to verify the parties’ fiscal standing to mitigate future risks.

- Reduction of bureaucratic barriers – The decision standardizes notary office procedures and eliminates inconsistencies across different states and municipalities.

TM Associados Recommends:

- Maintain preventive tax oversight of real estate and transactions to ensure good faith and transparency.

- Advise buyers and sellers on the informational—not mandatory—nature of tax certificates to maintain legal certainty in property deals.

Source: CNJ Official Website

Accessed: Oct. 2025.

ITBI Immunity in Capital Contributions: STF Reviews New Case Under General Repercussion (Theme 1348)

Background

The dispute concerns the interpretation of Article 156, §2, I of the Federal Constitution, which grants ITBI (Real Estate Transfer Tax) immunity for capital contribution transactions, except when the company’s main activity is real estate (buying, selling, leasing, or commercial leasing of properties).

In 2021, the Supreme Federal Court (STF) addressed a similar issue in RE 796.376 (General Repercussion Theme 796), ruling that the immunity applies only to the portion of the property used to capitalize the company, excluding any excess value, such as bonuses or “torna” (balance due).

In that ruling, secondary remarks (obiter dictum) suggested that the exception for real estate activity applies only to corporate reorganizations (mergers, spin-offs, acquisitions)—not to capital contributions.

Current Discussion: Theme 1348 (RE 1.495.108)

The case currently under review by the STF directly addresses this issue. Once decided, it will bind all courts nationwide under the general repercussion rule.

The appeal was filed by a property-holding company challenging the ITBI charged by the Municipality of Piracicaba (SP) for contributing real estate to its share capital. The São Paulo Court of Justice (TJSP) upheld the tax, arguing that immunity does not apply when the company’s main activity is in real estate.

The trial began on October 3, 2025, in the STF Virtual Plenary.

Votes So Far (Partial Result: 3–0 in Favor of Immunity)

- Justice Edson Fachin (Rapporteur) – Voted in favor of unconditional immunity, stating the constitutional exception for predominant real estate activity only applies to reorganizations, not capital contributions.

- Justice Alexandre de Moraes – Fully agreed with the rapporteur.

- Justice Cristiano Zanin – Also agreed, with minor undisclosed caveats.

On October 7, 2025, Justice Gilmar Mendes requested a stay (additional time for review), suspending the vote. Under STF rules, he has up to 90 days to return the case, meaning the ruling could resume by January 2026.

The other justices—Barroso, Cármen Lúcia, André Mendonça, Nunes Marques, Flávio Dino, Fux, and Toffoli—have not yet voted.

Practical Significance: Impact for Holdings and Real Estate Companies

If the rapporteur’s opinion prevails, the STF will establish that ITBI immunity applies fully to capital contribution transactions, regardless of a company’s corporate purpose.

This would benefit real estate holding companies, developers, and family businesses that commonly use property contributions to increase capital. It would eliminate the main argument used by municipalities—that a real estate-related business purpose nullifies immunity, even if no real estate activity is effectively carried out.

The case is also considered a potential milestone in estate and succession planning, by reducing transaction costs and legal disputes with municipalities.

Economic and Fiscal Effects

Should full immunity be confirmed, the decision is expected to:

- Encourage investments and corporate reorganizations;

- Strengthen the real estate market;

- Reduce tax barriers for business structuring.

On the other hand, it could affect municipal tax revenues, which is already sparking discussions on whether the STF might modulate the decision’s effects to preserve fiscal predictability for local governments.

Theme 1348 – RE 1.495.108 (Piracicaba/SP)

Rapporteur: Justice Edson Fachin

STF Process Details

Accessed: Oct. 2025.

Labor Law

Labor Courts in Focus

The Labor Reform (Law No. 13,467/2017) was introduced as a landmark measure intended to reduce the number of lawsuits in the Brazilian Labor Courts. One of its most significant provisions required the losing party—even those granted legal aid (justice gratuity)—to pay court costs, attorney’s fees, and expert witness fees.

The impact was immediate. In 2017, the Labor Courts recorded approximately 3.9 million labor claims. By 2018, that number had dropped to 3.2 million, a decrease of nearly 19%. The decline continued in subsequent years, reaching 2.8 million in 2021, one of the lowest levels in history.

However, the scenario changed in 2022, following the Supreme Federal Court (STF) ruling in ADI 5,766. The Court decided that once legal aid is granted, the worker cannot be required to pay attorney’s fees, expert fees, or procedural costs, even if their claims are denied.

The effect was immediate: in the same year, the number of labor claims began to rise again, reaching 3.1 million. In 2023, there were 3.5 million, and in 2024, the figure hit a record 4 million, an increase of 39% compared to 2021.

Now, the issue has returned to the center of debate before the STF through Declaratory Action of Constitutionality (ADC) 80, filed by the National Confederation of the Financial System (CONSIF). The action requests that the granting of legal aid in labor proceedings depend on actual proof of financial hardship, rather than merely on a self-declaration of insufficiency—standard reinstated after ADI 5,766.

During the first session of ADC 80 in June 2025, Justice Edson Fachin, the rapporteur, voted to uphold the constitutionality of the Labor Reform provisions but maintained that a simple declaration of economic insufficiency should have relative presumption of truth. Soon after, Justice Gilmar Mendes requested a review (pedido de vista), suspending the case, which is expected to resume later this year.

The outcome will directly affect the behavior of workers, employers, and attorneys.

- If the STF decides that concrete evidence of financial hardship is required, the number of new labor lawsuits is likely to fall again.

- Conversely, if the self-declaration standard prevails, litigation rates will likely remain high.

The ruling in ADC 80 will therefore be crucial in defining the future of the Brazilian Labor Court system.

Conclusion

The debate over legal aid in labor proceedings represents far more than a procedural question—it directly impacts access to justice for workers and, at the same time, predictability and legal security for companies.

On one hand, it is essential to ensure that vulnerable workers are not prevented from pursuing their rights due to the fear of procedural costs.

On the other hand, it is equally important to discourage unfounded claims, which overload the judiciary and create uncertainty for employers.

The STF’s final decision in ADC 80 will be key to balancing these competing interests. The challenge lies in finding an equilibrium between facilitating access to justice and containing excessive litigation, thus shaping the direction of labor justice in the years to come.

Tax Law

Approval of Bill No. 1,087/2025 – Taxation on Dividends and High-Income Individuals

On October 1, 2025, the Chamber of Deputies approved Bill No. 1,087/2025, which amends Law 9,250/1995 and introduces two new frameworks for taxing individual income. The bill now moves to the Senate, but it already signals major changes that require immediate planning—including the potential anticipation of profit distributions before final approval.

1. Monthly Taxation of Profits and Dividends (Effective January 2026)

| Current Rule | New Rule |

|---|---|

| Distributions exempt since 1996 | 10% IRPF withholding tax on total monthly payments to an individual exceeding R$ 50,000 |

| — | Cumulative basis: if more than one payment occurs in the month, tax must be recalculated on the aggregate amount |

| — | Exemption maintained for profits earned up to 2025 and distributed by Dec 31, 2025 |

2. Minimum Annual Tax for High-Income Individuals (FY 2027, Base Year 2026)

| Annual Income Range | Effective Minimum Rate |

|---|---|

| Up to R$ 600,000 | 0% |

| R$ 600,000 – R$ 1.2 million | Linear increase from 0% to 10% |

| Above R$ 1.2 million | 10% on total base |

The taxable base includes nearly all forms of income (even exempt or exclusively taxed at source), with limited exceptions such as savings accounts, LCI/LCA, CRI/CRA, REITs (FIIs), and labor indemnities.

Amounts already withheld or paid on monthly distributions above R$ 50 thousand can be credited against the annual liability.

3. Practical Implications

- End of broad dividend exemption: monthly distributions above R$ 50 thousand will be subject to 10% income tax.

- Minimum effective tax floor: individuals who currently benefit from exemptions or favorable income categories will pay at least 10% IR if annual income exceeds R$ 1.2 million.

- Planning urgency: anticipate dividend distributions before final approval to avoid possible retroactive effects or changes to the effective date.

- Increased compliance demands: monthly calculations and annual minimum-tax reporting will require integrated accounting and tax controls.

4. Preparation Steps

- Assess the possibility of accelerating profit distributions before the legislative process concludes, considering potential changes in rates or timing.

- Monitor the bill’s progress in the Senate and possible amendments to rates, thresholds, or effective dates.

- Identify accumulated profits up to 2025 and, if feasible, approve distribution by 12/31/2025 to preserve exemption under Article 10 of Law 9,249/1995.

- Review dividend/pro labore policies to mitigate the impact of monthly withholding.

- Simulate the annual minimum-tax calculation to identify taxpayers who will owe additional tax and adjust investment or estate-planning strategies.

- If immediate distribution is not possible:

(i) hold a shareholder meeting approving conditional future distributions, or

(ii) consider financial instruments that provide liquidity for distribution within the exemption period.

5. How TM Associados Can Help

Our team is available to:

- Evaluate scenarios and prepare custom tax simulations;

- Review bylaws, minutes, and distribution policies;

- Design alternative compensation and remuneration plans;

- Monitor legislative developments and provide real-time alerts on changes to the bill.

Provisional Measure on IOF for Investments Rejected by the Chamber of Deputies

On October 8, 2025, the Chamber of Deputies approved a motion to withdraw from the agenda the Provisional Measure (MP) that sought to amend the rules for IOF (Tax on Financial Operations) on investments and financial transactions.

Without consideration within the legal 120-day period, the measure expires and will be archived without effect. It will not proceed to the Senate, and current IOF rules remain in force.

Background of the Provisional Measure

Issued by the Executive Branch, the MP proposed significant changes in various areas:

- Financial investments in derivatives and offshore funds;

- Life insurance policies with investment components (e.g., VGBL and PGBL);

- International transfers and foreign exchange operations.

According to government estimates, approval would have increased federal revenue by up to R$ 18 billion by 2026, directly affecting:

- Individuals with international investments;

- Companies with hedge or foreign-currency contracts;

- Wealth managers and insurers offering private pension products.

Despite its fiscal objective, the proposal met strong resistance in Congress and the market, which criticized the lack of prior debate, potential legal uncertainty, and possible disincentive to long-term savings.

What Changes with the Rejection

With the MP’s expiration:

- Current IOF rates and rules remain unchanged;

- Financial operations and investments continue to follow prior standards;

- The government must submit a new bill, subject to the regular legislative process, if it wishes to revisit the issue.

Institutional Assessment

The withdrawal and expiration of the MP highlight the importance of structured legislative debate when altering taxes that directly affect:

- Wealth and asset management for individuals and companies;

- Financial and estate planning for investors;

- The regulatory framework for funds and cross-border investments.

Furthermore, it reinforces that the IOF, by its extra-fiscal nature, must be used responsibly and predictably, rather than as a tool for emergency revenue collection.

Talk to Our Team

The Advisory and Tax Teams at TM Associados closely monitor all updates from the National Congress and the Federal Revenue Service regarding taxation of investments and financial operations, providing guidance to companies, asset managers, and investors in anticipation of potential regulatory changes.

We are ready to assist your business with legal security, strategic planning, and tailored solutions.

Leave a Reply

Want to join the discussion?Feel free to contribute!